- Login | Register | Contact Us |

- 中文版

Published on 04/08/2021 Tag: Singapore businesses, SMEs

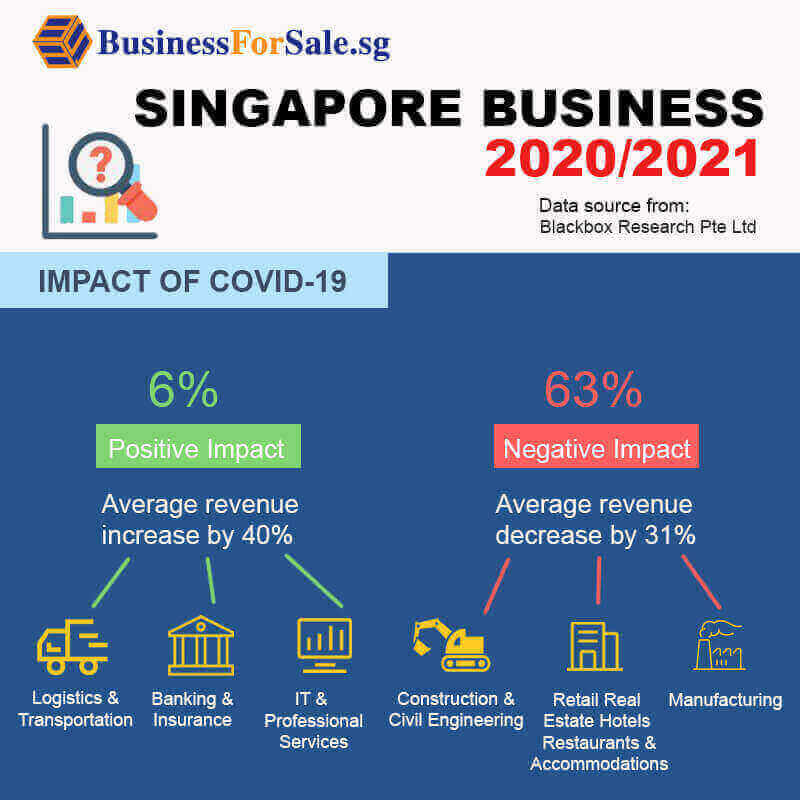

Singapore businesses are prepared to outlast the pandemic and many believe a three-pronged approach of focusing on workforce, technology and finances will be core in helping themselves emerge stronger from this crisis. Overall, about a third of Singapore businesses (31%) expect the business and economic climate to improve in the next 12 months, with an almost equal proportion (32%) predicting worsening conditions. Despite the negative sentiments, two in three companies (69%) are confident that they can sustain their businesses in the next 12 months. More than half of businesses (70%) believe full recovery will take 1-2 years. Without a doubt, cost support measures are most well-received by majority of the local businesses (88%), especially when it helps to cover the costs of paying salaries, rental and other expenses. Cost, cashflow and credit schemes are most pertinent to SMEs, while large companies find schemes related to talent, enterprise development as well as sector-specific support to be more relevant and useful.

Published on 04/08/2021 Tag: Singapore businesses, SMEs

Singapore businesses are prepared to outlast the pandemic and many believe a three-pronged approach of focusing on workforce, technology and finances will be core in helping themselves emerge stronger from this crisis. Overall, about a third of Singapore businesses (31%) expect the business and economic climate to improve in the next 12 months, with an almost equal proportion (32%) predicting worsening conditions. Despite the negative sentiments, two in three companies (69%) are confident that they can sustain their businesses in the next 12 months. More than half of businesses (70%) believe full recovery will take 1-2 years. Without a doubt, cost support measures are most well-received by majority of the local businesses (88%), especially when it helps to cover the costs of paying salaries, rental and other expenses. Cost, cashflow and credit schemes are most pertinent to SMEs, while large companies find schemes related to talent, enterprise development as well as sector-specific support to be more relevant and useful.